- Governor Sanwo-Olu flags off Ojota-Opebi Link Bridge, to be completed in 20 months

- Allow Nigeria go to 2022 World Cup, don’t play qualifiers – Ghana Parliament member tells Black Stars

- There was no second sex tape, Kim Kardashian refutes Kanye West’s claims

- Jaruma Remanded In Prison Over Post On Regina Daniels And Ned Nwoko

- Lanre Gentry confirms paternity of last son with Mercy Aigbe, says ‘He’s my son’ (Photo)

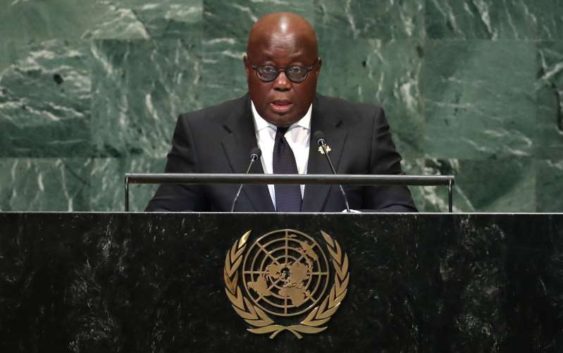

Ghana signs double taxation agreements with 10 countries

The Ghanaian government has signed double taxation agreements with 10 countries towards giving investors a stable and conducive tax scheme.

The government expressed the hope of signing more agreements to encourage investments and in turn, facilitate the transfer of skills and technology.

The Assistant Commissioner in charge of Legal Affairs and Treaties at the Ghana Revenue Authority, Eric Mensah, speaking at the Economic Counsellors’ Dialogue said the agreements were usually signed with the aim of eliminating juridical or economic double taxation.

The countries are Belgium, Denmark, France, United Kingdom, Switzerland, Mauritius, South Africa, Italy, Netherlands and Germany.

He said government had signed similar agreements with Barbados, Czech Republic, Seychelles, Singapore, Ireland, Malta, Qatar, and Morocco but yet to be enforced.

“Ghana had also held talks with Iran, Norway, Luxembourg, Portugal, Korea, Saudi Arabia, Nigeria and the United Arab Emirates but they are yet to sign an agreement,” he added.